Taxsutra TaxTonic – Myriad Facets of CSR Expenditure – Unravelled!

– January 2023

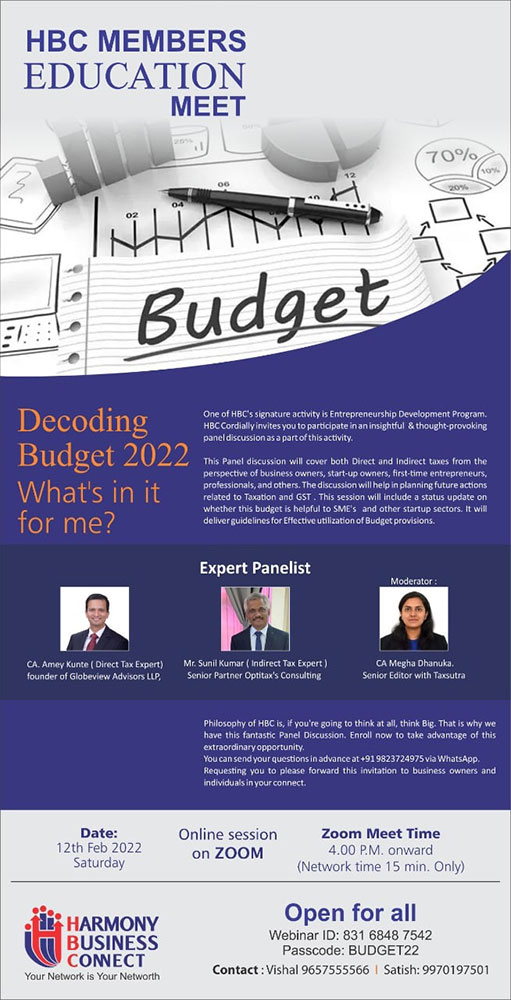

Budget 2022 Analysis for Harmony Business Connect – February 2022

Panelist during the IFA India Asia Pacific Conference on the topic

of “Remote/Hybrid working and Tax Considerations” October 2022

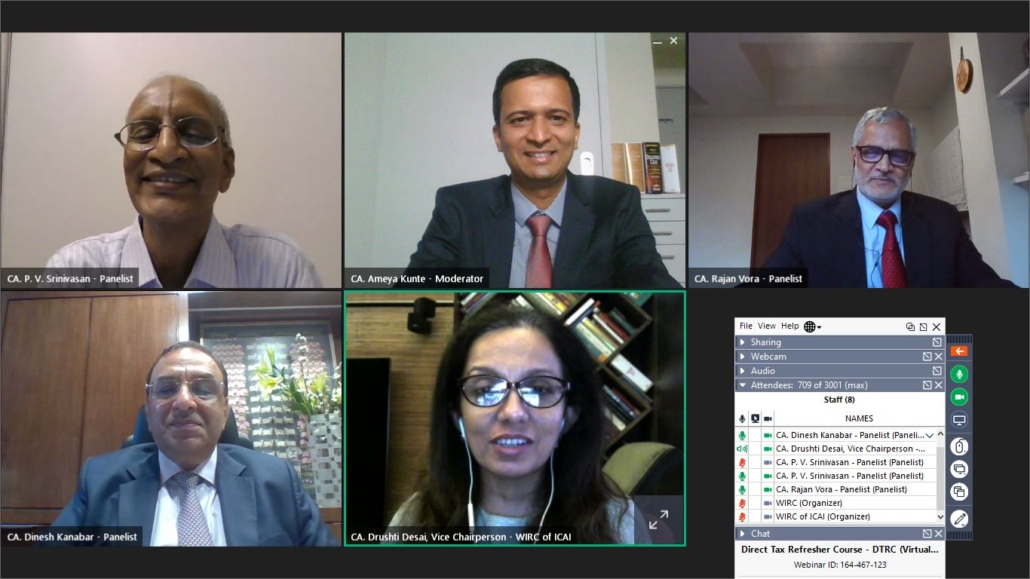

Impact of recent developments in tax laws of India regarding

digital transactions and OECD’s proposals on Pillar 1 & 2 –

jurisdictional issues, tax incidence, and TDS provisions – Hosted by

ICAI – April 2022

Panel Discussion on “OECD’s New Progress Report on Pillar One”!

hosted by Taxsutra – July 2022

Budget 2022 Analysis for Internal Auditors – March 2022

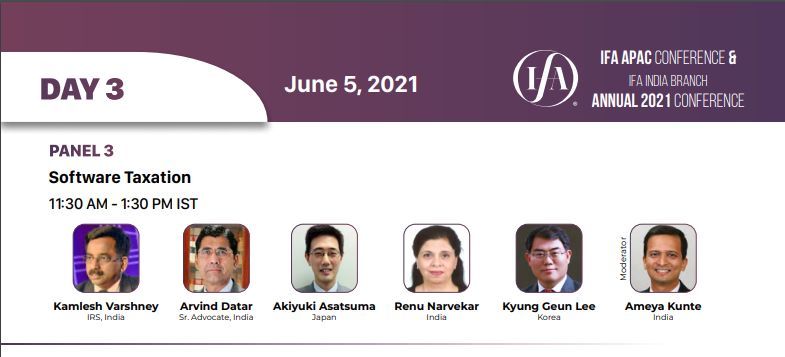

IFA Asia Pacific Conference 2021 – Panel discussion on Software Taxation

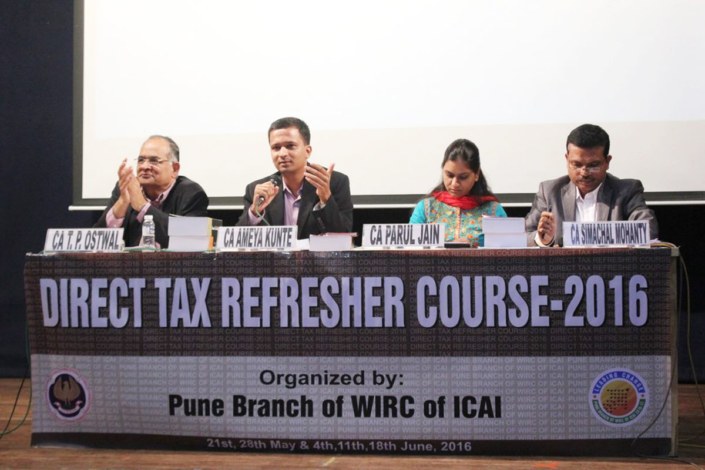

Panel discussion hosted by the Chamber of Tax Consultants